WorkCover insurance is a vital part of workplace safety and support in Glenhaven, NSW. It provides financial assistance and medical care to workers who suffer injuries or illnesses related to their job, helping them recover and return to work as smoothly as possible. Understanding how WorkCover works is essential for both employees and employers to ensure proper protection and timely assistance when workplace injuries occur.

What Is WorkCover Insurance and Why Is It Important?

WorkCover insurance is a compulsory insurance scheme in NSW designed to provide financial support and medical care to workers injured on the job. Unlike general insurance, WorkCover specifically covers work-related injuries and illnesses, helping workers cover medical expenses, lost wages, rehabilitation, and compensation. In Glenhaven, as in the rest of NSW, employers must have WorkCover insurance to comply with state laws and protect their workforce.

The insurance ensures that injured employees receive timely support, while employers fulfill their legal obligations. Understanding this system is the first step to securing your rights after a workplace injury.

WorkCover Policy Glenhaven NSW: What You Should Know

Every local Glenhaven business and worker needs to be aware of the details of their WorkCover policies. These policies define the scope of coverage, claim procedures, and key responsibilities. The Glenhaven community benefits from accessible services provided by clinics like Workcover. Hills Doctor, where experienced medical professionals assist with certificate issuance, assessments, and claim support.

Knowing your local contacts, such as Workcover.Hills Doctor, ensures that you get accurate medical evaluations and timely documentation needed to make successful claims. Local knowledge also helps employees and employers navigate the claim timelines specific to NSW regulations.

How Does WorkCover Insurance Work?

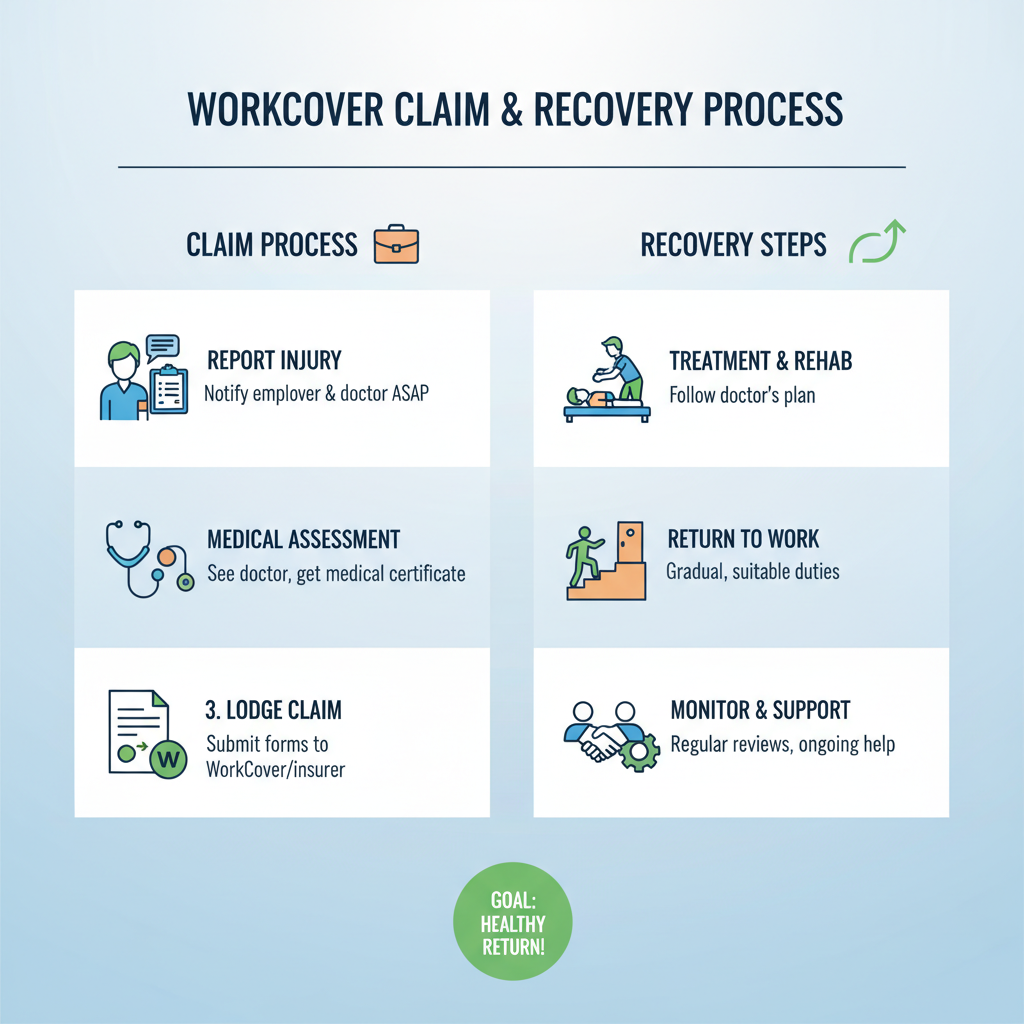

WorkCover insurance works by providing a safety net when workplace injuries occur. Once an injury is reported, a medical professional—often from local trusted clinics will assess the injury and issue a Certificate of Capacity indicating fitness for work or necessary restrictions. This medical evidence initiates the claim process with the insurer. Once the claim is lodged, injured workers receive weekly payments and coverage for medical treatments. The WorkCover insurer reviews the documentation, coordinates rehabilitation programs, and helps workers return safely to employment when possible.

How To Make a WorkCover Insurance Claim in Glenhaven

To file a claim, injured workers in Glenhaven should promptly report the injury to their employer and seek medical care from approved WorkCover doctors such as Workcover.Hills Doctor. Collect all medical reports, certificates, and evidence supporting your injury’s impact.

Claims must comply with NSW’s strict deadlines and assessment procedures. Assistance from experienced local clinics can improve claim accuracy and speed, reducing stress during recovery.

What Does WorkCover Insurance Cover?

WorkCover covers a wide range of injuries, including physical trauma, repetitive stress injuries, occupational diseases, and psychological conditions caused by work. Benefits include:

- Medical and hospital expenses

- Weekly compensation for lost wages

- Rehabilitation and return-to-work services

- Lump sum payments for permanent impairment

Understanding these coverages helps Glenhaven workers know their entitlements and encourages timely medical reporting.

Who Needs WorkCover Insurance?

In Glenhaven, all employers are required by law to hold this scheme for their workers. This includes small business owners who employ staff, contractors, and even part-time workers. Workers themselves depend on employer coverage to secure financial and medical support if injured.

At Workcover.Hills Doctor, we also assist small businesses in understanding their obligations and guiding workers throughout the claim process.

Frequently Asked Questions About WorkCover Insurance Glenhaven NSW

1. Is WorkCover insurance compulsory in Glenhaven NSW?

Yes, all employers must have WorkCover insurance to protect employees from workplace injury risks.

2.How do I get WorkCover insurance?

Employers can obtain coverage through approved insurers authorized by NSW State Insurance Regulatory Authority (SIRA).

3.What if my claim is denied?

Seek advice immediately. Clinics like Workcover.Hills Doctor collaborate with legal experts and rehabilitation services to support appeals.

4.Can I choose my own WorkCover doctor?

Yes, but it is recommended to consult local approved clinics like Workcover.Hills Doctor who specialize in WorkCover medical assessments.

In Glenhaven NSW, WorkCover insurance is a critical component for workplace safety and confidence. At Workcover.Hills Doctor, we’re here to help you understand, claim, and make the most of your rights under the system. Contact us today for expert, local support on your WorkCover journey.